Blog - Categories

Category: Mortgages (93 posts)

How Your 2025 Taxes Can Affect Your 2026 Mortgage Approval

January 23, 2026 | Posted by: Keith Leighton

How Your 2025 Taxes Can Affect Your 2026 Mortgage Approval January is when many people start thinking seriously about their finances for the year ahead. For both future home buyers and current ho ... [read more]

Mortgage Decisions to Get Right in 2026

January 9, 2026 | Posted by: Keith Leighton

Mortgage Decisions to Get Right in 2026 What Homeowners and Buyers Should Be Thinking About Now January is when many Canadians reset their goals, review their finances, and look ahead. If a home p ... [read more]

Mortgage Moves to Make Before Year-End

November 7, 2025 | Posted by: Keith Leighton

Mortgage Moves to Make Before Year-End The end of 2025 is a great time to take a fresh look at your finances, set goals for 2026, and make smart adjustments that can strengthen your financial posit ... [read more]

Steady Rates, Smart Moves: Mortgage Insights for Year-End Planning

October 31, 2025 | Posted by: Keith Leighton

Steady Rates, Smart Moves: Mortgage Insights for Year-End Planning Heading into the final stretch of 2025, many homeowners and buyers are taking a closer look at their mortgage options. The past fe ... [read more]

Autumn Insights: Is Now the Time to Re-evaluate Your Mortgage?

October 17, 2025 | Posted by: Keith Leighton

Autumn Insights: Is Now the Timeto Re-evaluate Your Mortgage? As the leaves turn and Atlantic Canada moves into the heart of fall, many homeowners are taking a closer look at their finances. One ... [read more]

Understanding Fall 2025 Mortgage Trends in Atlantic Canada

September 19, 2025 | Posted by: Keith Leighton

Understanding Fall 2025 Mortgage Trends in Atlantic Canada As summer turns to fall, many Atlantic Canadians begin to think about their next steps in homeownership. Whether it’s purchasing a f ... [read more]

How to Lock in a Fall Mortgage Rate Before the Market Shifts

August 8, 2025 | Posted by: Keith Leighton

How to Lock in a Fall Mortgage Rate Before the Market Shifts As the summer winds down and families get ready for back-to-school season, it is also a time when many Canadians start focusing on thei ... [read more]

Why More Atlantic Canadians Are Using Mortgage Brokers Over Banks

July 25, 2025 | Posted by: Keith Leighton

Why More Atlantic Canadians Are Using Mortgage Brokers Over Banks When it comes to getting a mortgage, more and more Atlantic Canadians are choosing to work with mortgage brokers instead of going s ... [read more]

Top 6 Mortgage Lessons Home Owners and Buyers Should Know

June 27, 2025 | Posted by: Keith Leighton

Top 6 Mortgage Lessons Home Owners and Buyers Should Know After more than two decades of helping Atlantic Canadians achieve homeownership, Ideal Mortgage is taking a moment to reflect on the key ... [read more]

Lending Options: Finding the Right Fit for Your Mortgage Needs

May 23, 2025 | Posted by: Keith Leighton

Lending Options: Finding the Right Fit for Your Mortgage Needs When it comes to buying or refinancing a home in Atlantic Canada, whether in Halifax, Moncton, Charlottetown or St. John’s, the ... [read more]

Hopping Into Homeownership: Your Easter Mortgage Guide

April 16, 2025 | Posted by: Keith Leighton

Hopping Into Homeownership:Your Easter Mortgage Guide Spring is in the air, and so is the scent of chocolate, blooming tulips, and fresh real estate opportunities! Easter is a time of renewal and w ... [read more]

Is Your Bank Really Giving You the Best Mortgage Deal?

April 10, 2025 | Posted by: Keith Leighton

Is Your Bank Really Giving You the Best Mortgage Deal? How to Spot Hidden Costs, Compare Offers Like a Pro, and Avoid Overpaying Out of Loyalty INTRODUCTION You’ve banked with them for year ... [read more]

How Mortgage Brokers Negotiate Better Rates: The Broker ADVANTAGE

March 27, 2025 | Posted by: Keith Leighton

How Mortgage Brokers Negotiate Better Rates: The Broker ADVANTAGE When it comes to buying a home, one of the biggest financial decisions you'll make is choosing the right mortgage. Everyone w ... [read more]

Atlantic Canada Mortgage Market Update: What the Latest BoC Rate Cut Means for You

March 20, 2025 | Posted by: Keith Leighton

Atlantic Canada Mortgage Market Update:What the Latest BoC Rate Cut Means for You The Bank of Canada (BoC) has once again reduced its policy rate by 0.25%, bringing its benchmark rate to 2.75%. For ... [read more]

How To Prepare For Your Mortgage Interview: A Guide For Homebuyers

March 12, 2025 | Posted by: Keith Leighton

How To Prepare For Your Mortgage Interview Purchasing a home is an exciting milestone, but before you can secure a mortgage, you'll need to go through a mortgage interview. This interview is a cruc ... [read more]

Will Mortgage Rates Drop This Spring? A Forecast for 2024

March 6, 2025 | Posted by: Keith Leighton

Will Mortgage Rates Drop This Spring? A Forecast for 2025 As spring approaches, many homeowners and prospective buyers in Atlantic Canada are eager to understand the direction of mortgage rates. Re ... [read more]

Spring Market Watch: What Homebuyers Need to Know

February 27, 2025 | Posted by: Keith Leighton

Spring Market Watch: What Homebuyers Need to Know As the snow starts to melt and daylight stretches a little longer, the real estate market in Atlantic Canada begins to heat up. March marks the un ... [read more]

Winter Mortgage Checkup: Stay Ahead of the Game

February 20, 2025 | Posted by: Keith Leighton

Winter Mortgage Checkup: Stay Ahead of the Game As the winter months roll in and we settle into the new year, it’s the perfect time to take stock of your mortgage. Just like you’d inspe ... [read more]

Impact of Trade Tensions on Mortgage Rates

February 6, 2025 | Posted by: Keith Leighton

Impact of Trade Tensions on Mortgage Rates In early February 2025, escalating trade tensions between the USA and Canada have raised concerns about potential economic repercussions, including the po ... [read more]

The Ripple Effect of U.S. Tariffs on Atlantic Canadian Homebuyers

January 23, 2025 | Posted by: Keith Leighton

The Ripple Effect of U.S. Tariffs on Atlantic Canadian Homebuyers As the world continues to grapple with economic uncertainties, global trade policies remain a key driver of market stability&mdash ... [read more]

New Year, New Home: How to Prepare for a Mortgage in 2025

January 16, 2025 | Posted by: Keith Leighton

New Year, New Home:How to Prepare for a Mortgage in 2025 The beginning of a new year is the perfect time to reflect on your financial goals, and for many Atlantic Canadians, homeownership is at the ... [read more]

How Holiday Splurging Can Affect Your Mortgage Goals

December 19, 2024 | Posted by: Keith Leighton

How Holiday Splurging Can Affect Your Mortgage Goals The holiday season brings joy and celebration, but overspending can have long-lasting effects on your financial health and homeownership plans ... [read more]

A Holiday Gift for Canadian Homebuyers: New Mortgage Rules and Rate Reductions

December 13, 2024 | Posted by: Keith Leighton

A Holiday Gift for Canadian Homebuyers: New Mortgage Rules and Rate Reductions As the holiday season unfolds, there’s an extra reason to celebrate beyond the joy of family gatherings and fe ... [read more]

Atlantic Canada Mortgage Landscape: December Insights

December 4, 2024 | Posted by: Keith Leighton

Atlantic Canada Mortgage Landscape As December rolls in and the year draws to a close, the mortgage market in Atlantic Canada continues to evolve. Whether you're looking to buy your first home, ref ... [read more]

Mortgage Rate War: How to Get the Best Deal

November 22, 2024 | Posted by: Keith Leighton

Mortgage Rate War: How to Get the Best Deal The Canadian mortgage rate war is expected to intensify as lenders increasingly compete for renewal business. As mortgage rates remain high and many home ... [read more]

November Insights for Homebuyers and Homeowners

October 31, 2024 | Posted by: Keith Leighton

November Insights for Homebuyers and Homeowners As November unfolds in Atlantic Canada, the mortgage market is adapting to a unique set of regional trends and national influences. This month’ ... [read more]

Spooky Savings: Why is a Mortgage Broker Your Best Treat This Halloween?

October 24, 2024 | Posted by: Keith Leighton

Spooky Savings: Why is a Mortgage BrokerYour Best Treat This Halloween? As Halloween approaches, spooky decorations and haunted houses are all around, but your mortgage shouldn’t be something ... [read more]

October Update: Mortgage Market in Review

October 18, 2024 | Posted by: Keith Leighton

October Update: Mortgage Market in Review As the crisp autumn air sweeps across Atlantic Canada, the real estate market in provinces like Nova Scotia, New Brunswick, Prince Edward Island, and Newfo ... [read more]

Fall Mortgage Market Trends

October 3, 2024 | Posted by: Keith Leighton

Fall Mortgage Market Trends As the fall season sets in, Atlantic Canadians are beginning to reassess their housing needs, with October being an ideal time to dive into the mortgage market. Whether ... [read more]

Atlantic Canada Mortgage Trends – Fall 2024

August 30, 2024 | Posted by: Keith Leighton

Atlantic Canada Mortgage Trends – Fall 2024 The mortgage market in Atlantic Canada is currently influenced by several trends. While there's been a year-over-year increase in housing prices ac ... [read more]

Creating a Mortgage Payoff Plan: Step-By-Step Guide

August 21, 2024 | Posted by: Keith Leighton

Creating a Mortgage Payoff Plan: Step-By-Step Guide Creating a mortgage payoff with the help of a mortgage broker can be a smart strategy. Mortgage brokers can provide tailored advice to reduce y ... [read more]

How to Choose the Right Mortgage Lender

July 18, 2024 | Posted by: Keith Leighton

How to Choose the Right Mortgage Lender Choosing the right mortgage lender involves considering several factors to ensure you get the best deal and service. Using a mortgage broker can be highly be ... [read more]

How to Use a Co-Signer for Your Mortgage

May 28, 2024 | Posted by: Keith Leighton

How to Use a Co-Signer for Your Mortgage A co-signer for your mortgage can be a helpful if you have difficulty qualifying for a mortgage on your own due to insufficient income, a short credit histo ... [read more]

Preparing Your Mortgage for Retirement

May 22, 2024 | Posted by: Keith Leighton

Preparing Your Mortgage for Retirement Ensuring financial stability in retirement is a paramount concern for Canadians. One significant aspect of this preparation involves managing your mortgage ef ... [read more]

How Do Mortgages Work?

May 2, 2024 | Posted by: Keith Leighton

How Do Mortgages Work? Mortgages function to finance the purchase of a home, allowing buyers to pay back the loan amount along with interest over a specified period. Here’s a detailed overvi ... [read more]

How to Read Your Mortgage Statement

April 11, 2024 | Posted by: Keith Leighton

How to Read Your Mortgage Statement Reading your mortgage statement is essential for understanding the details of your mortgage, including the outstanding balance, interest rates, and payments made ... [read more]

Unveiling Your Ultimate Mortgage Resource for Atlantic Canada

March 28, 2024 | Posted by: Keith Leighton

Unveiling YourUltimate Mortgage Resource for Atlantic Canada Buying a home in Atlantic Canada’s thriving real estate market is exciting, but the mortgage complexities can feel overwhelming. A ... [read more]

Is a Collateral Mortgage right for you?

March 21, 2024 | Posted by: Keith Leighton

What is a Collateral Mortgage? A collateral mortgage is a type of mortgage where the lender secures the loan by registering it as a charge against the borrower's property. In essence, the property ... [read more]

5 Things to Do Before Applying for a Mortgage

February 29, 2024 | Posted by: Keith Leighton

5 Things to Do Before Applying for a Mortgage Before applying for a mortgage, it's essential to ensure you're well-prepared and increase your chances of securing a favorable loan. The journey to fi ... [read more]

Is it a Smart Move to Wait for Lower Mortgage Rates?

November 17, 2023 | Posted by: Keith Leighton

Is it a Smart Move to Wait for Lower Mortgage Rates? In the ever-evolving landscape of the real estate market, potential homebuyers often find themselves contemplating the optimal time to make one ... [read more]

Mortgage Loans Made Friendly… Not Frightening

October 30, 2023 | Posted by: Keith Leighton

Mortgage Loans Made Friendly… Not Frightening Let's make mortgage loans less scary for Halloween. Imagine a spooky haunted house where all the ghosts, ghouls, and monsters are actually frien ... [read more]

Affordable Homeownership: Navigating the Challenges

October 19, 2023 | Posted by: Keith Leighton

Navigating the Challenges Owning a home signifies stability, security, and a sense of belonging. However, as property prices continue to rise, the path to homeownership has become increasingly chal ... [read more]

A Heartfelt Thanksgiving Message from DLC Ideal Mortgage

October 6, 2023 | Posted by: Keith Leighton

A Heartfelt Thanksgiving Messagefrom DLC Ideal Mortgage Dear Friends and Clients, As the crisp autumn leaves fall and the aroma of freshly baked pies fills the air, it's a gentle reminder that Tha ... [read more]

Home Appraisal Challenges: Why Not Use Your Appraisal Advocates

September 7, 2023 | Posted by: Keith Leighton

Home Appraisal Challenges: Why Not Use Your Appraisal Advocates Getting the best mortgage appraisal is crucial because it can affect your ability to secure a mortgage loan, refinance your existing ... [read more]

Elevate Your Homebuying Strategy with Mortgage Portability

August 30, 2023 | Posted by: Keith Leighton

Elevate Your Homebuying Strategy with Mortgage Portability When it comes to getting a mortgage, one of the more overlooked elements is the option to be able to port the loan down the line. Mortgag ... [read more]

Break Free from Big Banks - Enhance Your Mortgage Experience

August 17, 2023 | Posted by: Keith Leighton

Break Free from Big Banks: Enhance Your Mortgage Options It’s tough to get a mortgage these days. New and existing clients are being turned down by their bank. Mortgage lenders are being pre ... [read more]

What You Need to Know About Mortgage Rates.

July 7, 2023 | Posted by: Keith Leighton

What You Need to Know About Mortgage Rates While not the only factor to look at when choosing a mortgage, interest rates continue to be one of the more prominent decision criteria with any mortgage ... [read more]

Job Loss and Your Mortgage Application

June 9, 2023 | Posted by: Keith Leighton

Job Loss and Your Mortgage Application Whether you’ve made an offer on a home already or are still in the process of looking, you already understand that buying a home is likely the largest i ... [read more]

5 Tips to Pay Off Your Mortgage Faster

May 18, 2023 | Posted by: Keith Leighton

5 Tips to Pay Off Your Mortgage Faster Many of us dream of the day we will be mortgage-free. While most mortgages operate on a 25-year amortization schedule, there are some ways you can pay off you ... [read more]

What You Should Know About Mortgage Amortization

May 12, 2023 | Posted by: Keith Leighton

What You Should Know About Mortgage Amortization Your mortgage amortization period is the number of years it will take you to pay off your mortgage. Depending on your choice of amortization period, ... [read more]

Use a Trusted Mortgage Professional to Secure the Right Mortgage for You!

April 28, 2023 | Posted by: Keith Leighton

Whether you're buying your very first home, moving to a new property, purchasing a vacation or investment property, or renewing or refinancing an existing mortgage, there are many considerations t ... [read more]

Key Steps to Getting a Mortgage

April 19, 2023 | Posted by: Keith Leighton

Key Steps to Getting a Mortgage While the mortgage process can be daunting, we have broken it down into 5 easy steps to help you get started! Plus, a DLC Ideal Mortgage expert is happy to help guid ... [read more]

Make Your Mortgage Work for You

April 6, 2023 | Posted by: Keith Leighton

Make Your Mortgage Work for You. When it comes to mortgages, it can be easy to get overwhelmed by the sheer number of options! Fortunately, we are here to help! Below are some of the mortgage detai ... [read more]

How do I compare mortgages?

March 24, 2023 | Posted by: Keith Leighton

How do I compare mortgages? The best mortgage for your situation should meet your needs while providing the lowest rates and the best terms and conditions.Decide on a loan type. Learn more about wh ... [read more]

8 Important Overlooked Mortgage Factors To Consider

November 17, 2022 | Posted by: Keith Leighton

8 Important Overlooked Mortgage Factors To Consider When it comes to getting a mortgage, there is a common misperception that a low rate is the most important factor. However, while your rate does ... [read more]

How to Choose the Best Mortgage for You (Part 3 of 3)

October 6, 2022 | Posted by: Keith Leighton

How to Choose the Best Mortgage for You(Part 3 of 3) Shopping for a mortgage can affect how much you pay each month and over the life of the loan. Doing your research before you buy can save you mo ... [read more]

How to Choose the Best Mortgage for You (Part 2 of 3)

October 4, 2022 | Posted by: Keith Leighton

How to Choose the Best Mortgage for You(Part 2 of 3) Shopping for a mortgage can affect how much you pay each month and over the life of the loan. Doing your research before you buy can save you mo ... [read more]

How to Choose the Best Mortgage for You (Part 1 of 3)

September 28, 2022 | Posted by: Keith Leighton

How to Choose the Best Mortgage for You (Part 1 of 3) Shopping for a mortgage can affect how much you pay each month and over the life of the loan. Doing your research before y ... [read more]

The Real Deal about Transfers and Switches

September 15, 2022 | Posted by: Keith Leighton

The Real Deal about Transfers and Switches Most people who are thinking about a transfer or switch want to take advantage of a lower interest rate or to get a new mortgage product with terms that ... [read more]

Rising Mortgage Rates Don’t Spell Disaster

August 25, 2022 | Posted by: Keith Leighton

Rising Mortgage Rates Don’t Spell Disaster While homeowners and home buyers are groaning about these higher mortgage rates, they’re not all bad. And in fact, if you look at them from a ... [read more]

5 Reasons Why You May Not Qualify for a Mortgage.

August 16, 2022 | Posted by: Keith Leighton

5 Reasons Why You May Not Qualify for a Mortgage. When it comes to shopping for a mortgage, it is important to know what you need to qualify – but it is just as important to understand some ... [read more]

6 Mortgage Tips That Will Save You Time and Money

August 12, 2022 | Posted by: Keith Leighton

6 Mortgage Tips That Will Save You Time and Money If your mortgage is up for renewal, or if you’re about to buy a home for the very first time, there are certain factors to consider, to ensur ... [read more]

3 Things You May Not Know About Cash-Back Mortgages

August 5, 2022 | Posted by: Keith Leighton

3 Things You May Not Know About Cash-Back Mortgages It can get pretty exciting to see campaigns around “cash-back mortgages” but, before you get too far along, here are three things y ... [read more]

Staying Out of the Penalty Box

February 4, 2022 | Posted by: Keith Leighton

Staying Out of the Penalty Box When it comes to mortgages, it is easy to focus on the rates and your current situation, but the reality is that life happens and when it does, rates won’t be t ... [read more]

How to Save with a Variable Mortgage.

January 14, 2022 | Posted by: Keith Leighton

How to Save with a Variable Mortgage. When it comes to mortgages, the age-old question remains: “Should I go with a variable or fixed-rate?”. To make an informed decision, it is importa ... [read more]

10 Mortgage Mistakes to Avoid

September 16, 2021 | Posted by: Keith Leighton

10 Mortgage Mistakes to Avoid Whether it is your first house or you’re moving to a new neighborhood, getting approved for a mortgage is exciting! However, even if you have been approved and ... [read more]

What Your Banker Won't Tell You!

May 28, 2021 | Posted by: Keith Leighton

What Your Banker Won't Tell You! Did you know the biggest difference between getting your mortgage from a bank vs a mortgage broker is that the bank only has access to their products, while I, your ... [read more]

25 Secrets Your Banker Doesn’t Want You to Know.

May 14, 2021 | Posted by: Keith Leighton

25 Secrets Your Banker Doesn’t Want You to Know. Twenty-five or thirty years can sound like an impossibly long time to service a loan – and for many of us, it is. If you are looking to ... [read more]

Get Your Spring Mortgage Checkup!

April 30, 2021 | Posted by: Keith Leighton

Get Your Spring Mortgage Checkup! Warmer spring temperatures brings the chance for a fresh start. It’s important to conduct a spring checkup on your mortgage. So often, homeowners lock into a ... [read more]

Reasons for an Annual Mortgage Review

December 4, 2020 | Posted by: Keith Leighton

Reasons for an Annual Mortgage Review Life does not stand still… our schedules change, our needs change, and even our goals can change. Success and even happiness are often moving targets. T ... [read more]

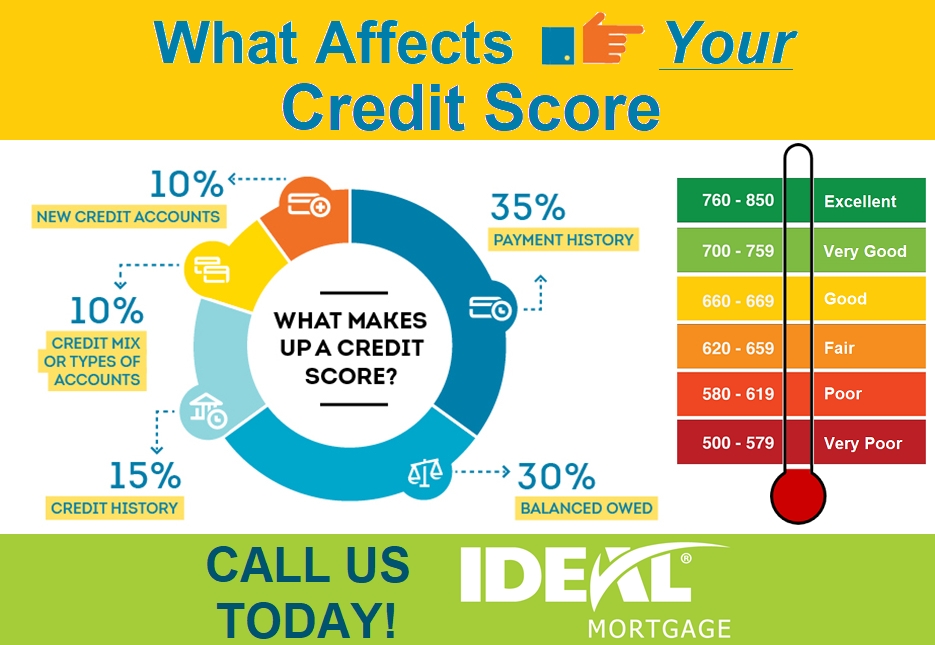

Applying For a Mortgage: What Lenders Are Looking For

November 13, 2020 | Posted by: Keith Leighton

Applying For a Mortgage: What Lenders Are Looking For When you apply for a loan it’s important to understand what lenders look for in their applicants. Of course, depending on the t ... [read more]

Meet Nick Hamblin

July 28, 2020 | Posted by: Keith Leighton

Meet Nick Hamblin #mortgage #realestate #realtor #mortgagebroker #home #newhome #realestateagent #investment #property #househunting #refinance #firsttimehomebuyer #forsale #finance #broker #mort ... [read more]

Why Mortgage Brokers are Better than Banks!

July 28, 2020 | Posted by: Keith Leighton

Why Mortgage Brokers are Better than Banks! I am often asked if it’s hard to compete with the banks. While they may offer competitive rates at times, right now we have much better rates than ... [read more]

5 C’s of Credit to get a Mortgage

July 28, 2020 | Posted by: Keith Leighton

5 C’s of Credit to get a Mortgage Whether you are buying your first home or have been a home owner for years, when you are looking at purchasing a property, finding the best mortgage solution ... [read more]

10 Things That Determine Your Best Mortgage Rate

July 28, 2020 | Posted by: Keith Leighton

10 Things That Determine Your Best Mortgage Rate You know at one time I could give you a quote over the phone and not worry that I would be too far out. Today is a totally different story, here a ... [read more]

4 Ways to Enable a Smooth Mortgage Process

July 28, 2020 | Posted by: Keith Leighton

4 Ways to Make the Mortgage Process SmootherMortgages are complicated—we get it! But there are steps that you as a homebuyer can take to make the process a much smoother one (plus let you walk ... [read more]

Why Are Mortgage Rates Rising?

July 28, 2020 | Posted by: Keith Leighton

Why Are Mortgage Rates Rising? Over the past month, the Bank of Canada has lowered its overnight rate by a whopping 1.5 percentage points to a mere 0.25%. Many people expected mortgage rates to fal ... [read more]

COVID-19: Understanding Mortgage Payment Deferral

July 28, 2020 | Posted by: Keith Leighton

COVID-19: Understanding Mortgage Payment Deferral What you can do about your mortgage payment during the pandemic. The COVID-19, or coronavirus crisis has left many homeowners in Canada without ... [read more]

The Math on Mortgage Deferrals

July 28, 2020 | Posted by: Keith Leighton

The Real Costs. The Facts. The Myths. There are opinions and articles circulating that say taking the 6 month mortgage deferral option could result in your payments increasing by $800 a month at th ... [read more]

Canadian Interest Rates Fall to Near Historic Lows

July 28, 2020 | Posted by: Keith Leighton

CANADIAN INTEREST RATES FALL TO NEAR HISTORIC LOWS Interest rates have fallen to near historic lows due to the Covid-19 pandemic that has ravaged the economy and caused widespread unemployment. Th ... [read more]

Winter is here! Get a worry free mortgage!

January 28, 2019 | Posted by: Keith Leighton

Winter is here! Get a worry free mortgage! This time of year, there are a few less mortgage’s being done- not many people want to move into a new home in the snow. But if you want to get a wo ... [read more]

Do’s and Don’ts for the Mortgage Process around CHRISTMAS

December 4, 2018 | Posted by: Keith Leighton

Do’s and Don’ts for the Mortgage Process around CHRISTMAS The holiday season is always a crazy time, but that’s no reason not to take advantage of the great housing market an ... [read more]

Should I Lock in A Mortgage Rate?

November 28, 2018 | Posted by: Keith Leighton

Should I Lock in A Mortgage Rate? This post applies if you are taking a new mortgage, whether it’s for a purchase, refinance, or renewal. The variable remains the main contender. But what ab ... [read more]

Are you Getting a Fixed-rate mortgage? Some things to consider!

October 12, 2018 | Posted by: Keith Leighton

Are you Getting a Fixed-rate mortgage? Some things to consider! Are you considering a 25-year amortization or 30 years? Insured or Uninsured? With an A Lender or B Lender? These are just a few of t ... [read more]

Navigating The Mortgage Rate Wars

August 24, 2018 | Posted by: Keith Leighton

How to Navigate The Mortgage Rate Wars You may have heard that rates are changing, and that is true. They don’t call it war for nothing and you need an expert by your side! Think of mortgage ... [read more]

It’s all about the property

July 10, 2018 | Posted by: Keith Leighton

With all of the rule changes imposed by the federal and provincial governments around mortgage financing and real estate it may be more difficult to access financing. But don’t take it persona ... [read more]

Are You Ready for a Last Minute Credit Check?

June 6, 2018 | Posted by: Keith Leighton

Are You Ready for a Last Minute Credit Check? Your credit history is one of the single greatest factors in determining whether you can become qualified for a mortgage and the interest rate you ca ... [read more]

What is a Collateral Mortgage?

May 18, 2018 | Posted by: Keith Leighton

What is a Collateral Mortgage? A collateral mortgage is a way of registering your mortgage on title. This type of registration is sometimes used by banks and credit unions. Monoline lenders, on the ... [read more]

Does your financial house need a good Spring Clean?

May 15, 2018 | Posted by: Keith Leighton

Does your financial house need a good Spring Clean? Wouldn't spring cleaning be so much more gratifying if - somewhere under some old clothes and worn out jeans in your dresser - you found an envel ... [read more]

Your Mortgage Could Be A Goldmine of Potential Savings

May 9, 2018 | Posted by: Nick Hamblin

A penny saved is a penny earned! By making the right decisions, your mortgage could be a goldmine of potential savings. With access to a broad spectrum of over 30 lenders, Ideal Mortgage professi ... [read more]

Five Ways to Improve Mortgage Qualifying Success

March 19, 2018 | Posted by: Nick Hamblin

Five Ways to Improve Mortgage Qualifying Success Yes new mortgage rules have made it harder to qualify for a mortgage, whether you are a first-time buyer or looking to renew or refinance your mortg ... [read more]

Should You Spend the Full Mortgage Amount You're Approved For?

June 7, 2017 | Posted by: Nick Hamblin

Before you start shopping for a new home, you'll need to know exactly how much house you can afford. Otherwise, you could end up in a home that is way out of your budget. What you qualify for may not ... [read more]

Take Advantage of Low Interest Rates – Refinance Your Mortgage Today!

May 31, 2017 | Posted by: Nick Hamblin

Borrowers are loving the current record low interest rates, and homeowners stand to benefit even more. If you bought your home more than a few years ago, you could probably benefit from a refinance ... [read more]